When you pick up a prescription, the price on the receipt doesn’t tell the whole story. Two people with the same condition, same insurance, and same doctor might pay wildly different amounts just because one got a generic and the other got the brand name. The truth? Generics are almost always cheaper-but sometimes, they’re not. And in some cases, the brand-name drug ends up costing you less. Here’s why.

Generics Work the Same Way

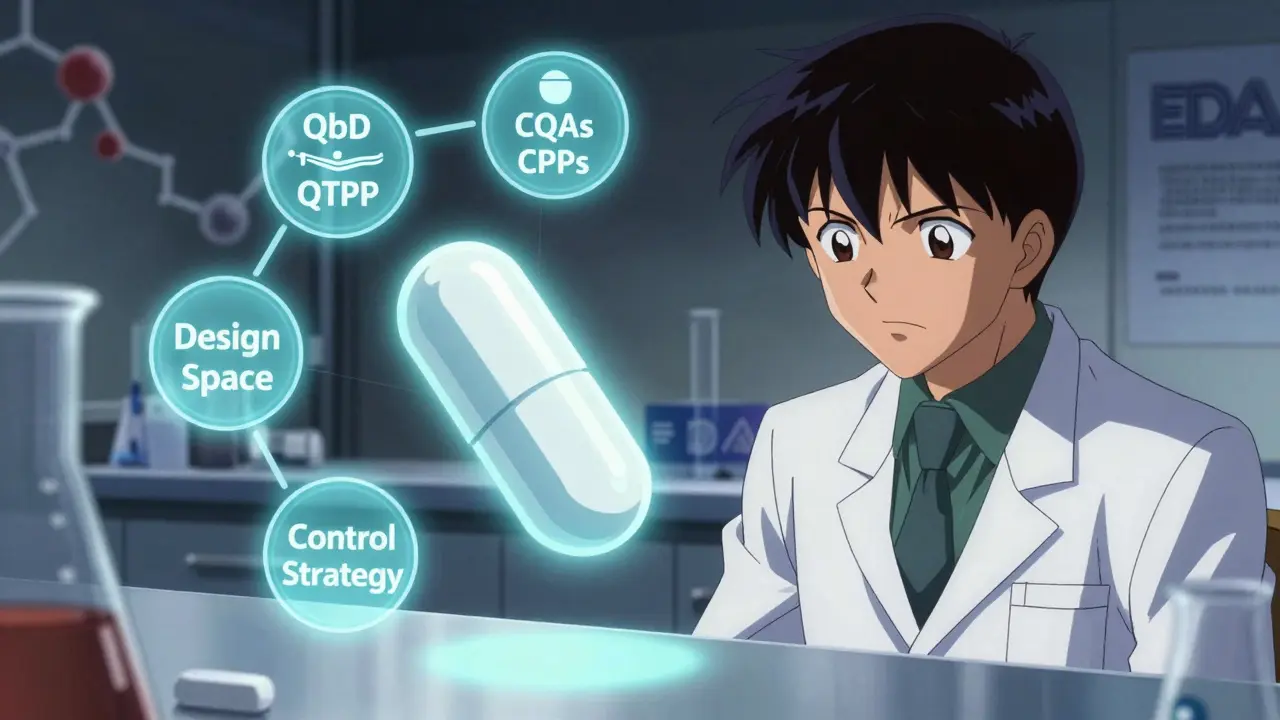

Before we talk about cost, let’s clear up a myth: generics aren’t weaker, older, or lower quality. The FDA requires them to have the exact same active ingredient, strength, dosage form, and route of administration as the brand-name version. They must also prove they’re absorbed into the body at the same rate and to the same extent. That’s called bioequivalence. If you take a generic metoprolol or omeprazole, your body treats it just like the brand-name version. The only differences? The inactive ingredients-like fillers or dyes-and the shape or color of the pill. These don’t affect how the drug works.On Average, Generics Cost 80-85% Less

Across the board, generic drugs cost far less. In the U.S., about 90% of all prescriptions filled are for generics. But here’s the twist: even though they make up 9 out of 10 prescriptions, they account for only about 18% of total prescription spending. Why? Because brand-name drugs are priced so high. A single 30-day supply of a brand-name drug can cost $300 or more. The generic version? Often under $10. For drugs like clopidogrel or pantoprazole, patients using generics save an average of $40 to $100 per month.But Insurance Design Changes Everything

Your out-of-pocket cost isn’t just about the drug’s list price-it’s about your insurance plan. There are three main ways plans charge you:- Copay: You pay a flat fee, like $10 or $20, no matter what the drug costs. If your plan has a $10 copay for generics, you pay $10-even if the drug drops from $50 to $5. Your insurer covers the rest.

- Coinsurance: You pay a percentage, like 20% or 30%. If your drug costs $100 and your coinsurance is 20%, you pay $20. If the price jumps to $150, you pay $30.

- Deductible: You pay the full price until you hit a certain amount (say, $1,500). After that, you pay coinsurance or a copay.

The Medicare Part D Trap

This is where things get strange. In Medicare Part D, there’s a coverage gap called the “donut hole.” Once you and your plan spend a certain amount on drugs, you enter this gap-and you pay more. But here’s the catch: brand-name drug manufacturers are required to give discounts in the donut hole. Those discounts count toward your out-of-pocket spending, helping you get out of the gap faster. Generic drug makers? They don’t have to give those discounts. So if you’re taking a high-priced generic-like a specialty version of gabapentin or metoprolol-you might have to spend nearly $3,730 to get out of the donut hole. Meanwhile, someone on a brand-name drug might only need to spend $982. That’s not a typo. You pay more out of pocket for the generic. This isn’t a mistake. It’s how the system was designed. And it means that even though generics are cheaper upfront, they can cost you more in the long run under Medicare Part D.When Cash Beats Insurance

Here’s another surprise: sometimes, paying cash for a generic is cheaper than using your insurance. That’s because insurers and pharmacy benefit managers (PBMs) negotiate prices behind closed doors. The price your insurer pays isn’t always the price you see on your bill. Sometimes, the “discounted” price your insurance gives you is still higher than what a cash-only pharmacy charges. Companies like Mark Cuban Cost Plus Drug Company or Blueberry Pharmacy sell generics at transparent, low prices-often 40-70% below what insurance charges. A 2024 study found that 11.8% of generic prescriptions cost less when paid for in cash, with median savings of $4.96 per prescription. For uninsured patients, the savings were huge. For Medicaid patients? Almost none. Why? Medicaid already has negotiated rates that are lower than cash prices. If you’re on a high-deductible plan or pay a lot in coinsurance, it’s worth checking cash prices before you swipe your card. You might save $10, $20, or even $50 on a single prescription.

Why Do Brand-Name Drugs Still Dominate Spending?

Even though generics make up 90% of prescriptions, they only account for 18% of total spending. That’s because brand-name drugs are priced like luxury goods. A single 30-day supply of a brand-name drug can cost $500 or more. And while manufacturers offer rebates to insurers, those rebates don’t always reach you. The list price goes up, your copay stays the same, and you never know the difference. In 2020 alone, generics saved the U.S. healthcare system $338 billion. Over 10 years, that’s nearly $2.4 trillion. But patients still pay billions more than they should because of middlemen, lack of price transparency, and supply chain inefficiencies. One study found patients may be overpaying for generics by 13-20% simply because no one is forcing prices down.What You Can Do

You don’t have to accept whatever price you’re given. Here’s what works:- Ask your doctor if a generic is available. If they say no, ask why. Sometimes, they just default to the brand.

- Check your insurance plan’s formulary. See what tier your drug is on and what your copay or coinsurance is.

- Use GoodRx or similar apps to compare cash prices at nearby pharmacies. Sometimes, the best deal isn’t through your insurance.

- If you’re on Medicare Part D, calculate your total out-of-pocket spending. If you’re on a high-priced generic, you might be stuck in the donut hole longer than someone on a brand-name drug.

- Ask your pharmacist to check if the generic is the same as the brand. If you’ve had side effects, it’s worth asking if the filler or dye changed.

Final Reality Check

Generics are safe. Generics are effective. And in most cases, they’re cheaper. But the U.S. drug pricing system is broken. It rewards complexity over fairness. You might pay more for a generic because of your insurance plan. You might pay less for a brand-name drug because of how Medicare works. And sometimes, the best deal is paying cash. Don’t assume the pharmacy’s first price is the lowest. Ask questions. Compare options. And remember: you’re not just a patient-you’re a consumer. And you have more power than you think.Are generic drugs as effective as brand-name drugs?

Yes. The FDA requires generic drugs to contain the same active ingredients, dosage, and strength as their brand-name counterparts. They must also prove they’re absorbed the same way in the body. Generics are just as safe and effective. The only differences are in inactive ingredients like fillers or colorants, which don’t affect how the drug works.

Why do some generics cost more than brand-name drugs?

This mostly happens in Medicare Part D. Because brand-name manufacturers give discounts in the coverage gap (donut hole) that count toward your out-of-pocket spending, patients on brand-name drugs can reach catastrophic coverage faster. Generic manufacturers don’t offer these discounts, so patients on high-priced generics may need to spend over $3,700 to get out of the gap-compared to under $1,000 for brand-name drugs. It’s a policy quirk, not a reflection of drug quality or cost.

Should I always choose the generic version?

In most cases, yes. Generics are cheaper and just as effective. But if you’re on Medicare Part D and taking a high-priced generic, check whether switching to the brand-name version could help you get out of the coverage gap faster. Also, if you’ve had side effects with a generic, talk to your doctor-it could be due to an inactive ingredient, not the active drug.

Can I save money by paying cash instead of using insurance?

Yes, especially for generics. Many cash-only pharmacies like Mark Cuban Cost Plus Drug Company or Blueberry Pharmacy sell generics at prices lower than what insurance plans charge. In one study, 11.8% of generic prescriptions were cheaper when paid in cash, saving patients an average of $4.96 per prescription. If you’re on a high-deductible plan or pay high coinsurance, it’s worth checking cash prices before using your insurance.

Why are brand-name drugs so expensive?

Brand-name drug prices are set by manufacturers with little regulation. They often rise far faster than inflation-sometimes by over 15% in two years. Even when manufacturers offer rebates to insurers, those savings rarely reach patients. The system rewards high list prices because rebates are negotiated behind closed doors. Patients end up paying more through coinsurance or deductibles, even if the actual cost to insurers drops.

How can I find out what my out-of-pocket cost will be?

Call your pharmacy and ask for the cash price. Then ask your insurance company for your estimated cost under your plan’s formulary. Compare both. If you’re on Medicare Part D, use the Medicare Plan Finder tool to model your total spending based on your medications. Don’t rely on the first price you’re given-always check alternatives.

Angela Stanton

January 8, 2026 AT 23:32Okay but let’s be real - the Medicare donut hole is a scam disguised as a policy. 🤦♀️ Generic gabapentin costs $1.50 cash but $370 out-of-pocket in the gap? That’s not a loophole, it’s a trap. And pharma companies? They designed it ON PURPOSE. 😤

Alicia Hasö

January 9, 2026 AT 21:15This is exactly why we need systemic reform - not just individual hacks. Patients shouldn’t have to become pharmacoeconomists just to afford their medication. The fact that a life-saving drug can cost more if it’s generic is a moral failure, not a market quirk. We owe our neighbors better than this.

Matthew Maxwell

January 11, 2026 AT 02:29It’s not complicated. If you can’t afford your meds, you shouldn’t be on them. People who rely on generics are often the same ones who don’t take their pills consistently anyway. Why should taxpayers subsidize noncompliance? The system works fine - you just need to be responsible.

Lindsey Wellmann

January 12, 2026 AT 06:46OMG I JUST REALIZED I’M PAYING MORE FOR MY GENERIC METOPROLOL THAN THE BRAND BECAUSE OF THE DONUT HOLE 😭 I’M CRYING IN THE PHARMACY LINE RIGHT NOW. 🥲💊 #MedicareIsABetrayal #GenericPain

Jacob Paterson

January 12, 2026 AT 23:18Oh, so now we’re blaming the system? How about blaming the people who let their insurance companies screw them? If you don’t read the fine print, you deserve to get fleeced. I’ve been paying cash for 8 years - and I’m not a genius. I just didn’t trust the system. Maybe you should’ve done the same.

Elisha Muwanga

January 13, 2026 AT 08:36This is what happens when you let foreigners and corporations control our medicine. America used to make drugs. Now we pay more than any country on Earth for pills made in China or India. Shameful. We need tariffs. We need buy-American policies. This isn’t healthcare - it’s economic colonialism.

Ashley Kronenwetter

January 15, 2026 AT 04:12Thank you for this thorough breakdown. I’ve been advising patients on this exact issue for over a decade. The disconnect between list price and out-of-pocket cost is one of the most under-discussed problems in primary care. Please share this with your providers - they rarely know either.

Aron Veldhuizen

January 16, 2026 AT 09:58Here’s the philosophical layer no one wants to admit: the entire pharmaceutical system is built on the illusion of scarcity. Patents are monopolies masquerading as innovation incentives. But if a molecule can be replicated exactly - and is chemically identical - then why is it ‘owned’? The idea of intellectual property in medicine is a capitalist myth that kills people. Generics aren’t cheaper because they’re inferior - they’re cheaper because they’re honest.

Heather Wilson

January 17, 2026 AT 08:42Wait, so you’re saying I should pay cash for my generic? But my insurance has a $5 copay. Are you telling me to pay $12 instead? That’s not saving money. This whole article is misleading. Also, why do you keep saying ‘pharmacy benefit managers’ like it’s a bad thing? They’re the ones negotiating. You’re just mad because you don’t understand how insurance works.

Micheal Murdoch

January 18, 2026 AT 14:15Hey - if you’re reading this and feeling overwhelmed, you’re not alone. I’ve been there. I used to pay $120 a month for my generic blood pressure med until I found a local pharmacy that sold it for $8 cash. It took me three calls. Three. That’s all it took. You don’t need to be a genius. You just need to be stubborn. And maybe use GoodRx. You got this.

Jeffrey Hu

January 19, 2026 AT 07:25Actually, the 80-85% stat is outdated. The real average savings for generics is closer to 40-60% after rebates and PBMs get their cut. And don’t get me started on the ‘cash is cheaper’ myth - that only works for low-cost generics. Try it with a 30-day supply of levothyroxine and see what happens. Spoiler: your insurance still wins.

Drew Pearlman

January 20, 2026 AT 09:54I just want to say - thank you for writing this. I’m a single dad on a high-deductible plan, and I used to skip my generic statin because it cost $75. Then I found a local clinic that gives me the same pill for $12 cash. I’m alive today because I learned to question the price tag. You’re not broken. The system is. Keep fighting. You’re not alone.